What might farmers and local councils teach us about the buyer-supplier dynamic?

How might we use this to forge stronger relationships with third-parties and encourage ethics & compliance vigilance?

Supermarket swipe

(Some/most) supermarkets dictate prices to farmers. Farmers’ costs have sky-rocketed (war, energy, regulation). If you think these increased costs are creating your higher food bills, that’s highly misleading. The four largest UK supermarkets (accounting for 2/3 market share) have announced record profits.

Bad council

Local councils are also raising taxes, with many of their constituents experiencing diminished services. Some will argue that austerity and ministerial incompetence shrunk their real budgets. That seems a good argument but doesn’t fully explain the malaise. If you look into how much funding goes on non-frontline service provision (I did, and it’s scary), it’s hard to argue with the Feb 2022 assessment of the Public Accounts Committee:

“Chronic lack of accountability and transparency in local government finance will hamper pandemic recovery.”

Bring it back to me

So what’s this got to do with risk, ethics, compliance, etc. and buyers and suppliers?

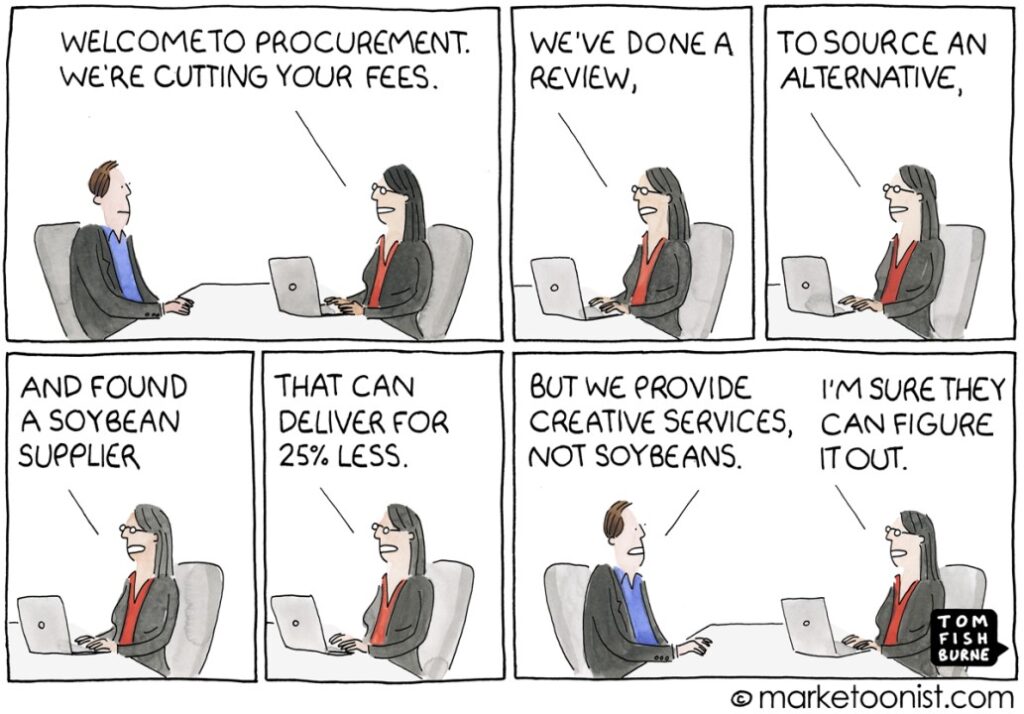

Some buyers act like bullies. This behaviour isn’t necessarily driven by malintent – it’s often the result of overzealous “cost-saving edicts” or procurement teams incentivised to drive the price down, not maximise utility. You see if you treat people like stones from which you try and squeeze blood, they’re probably not going to go above and beyond for you. You get a “competitive price”, and a begrudging service.

Before I started Ethics Insight, I’d watch my wife (a long-time solopreneur before she started her own biz). Some clients would be collaborative and reasonable – she’d intentionally (and unintentionally) over-deliver, throwing in things that (usually) didn’t cost her much but added considerable value to the client. Then there were the clients who’d haggle on every cent, try and add *extras*, pay late (occasionally never, or not the agreed amount), and change deliverables and timing on a whim. Unsurprisingly, they got the bare minimum.

You get what you give.

Over to you

On the other side of the equation, particularly in risk advisory land, there are a wide variety of providers. Some will use smoke ‘n’ mirrors to try and pretend that the CTRL+A, CTRL+C, then CTRL+V (into a template with hopefully your organisation’s name changed) represents a “bespoke” analysis or report. Others will seek to bind you to their services by issuing reports citing lots of problems only they can solve, aware that submission of the report is evidential (should regulators come a knocking). Others simply overstate capabilities – or, more accurately, use the bait & switch (someone competent and qualified woos you, someone underpaid and undertrained botches the job).

There are, of course, stand-up providers, but it can be hard to identify them if you’ve not worked on their side of the aisle. With topics including due diligence, investigations, data analytics, and content creation (training, comms, etc.), it can be difficult (initially) to discern useable from useless. The trick is to ask the organisation how they do what they do – competent companies will welcome this opportunity, and shysters will hide behind veneers of secret sauce (often termed “proprietary knowledge”).

Much ado about nothing

It’s commonsensical, and I know you will know all this. But maybe some colleagues don’t. So here goes…

If you’re a buyer, don’t treat third-parties as squeezable vendors. Negotiate, of course, but if you push it too far, these things happen:

😬 Lost trust and respect = less commitment to quality and your standards (including integrity)

😬 The vendors go elsewhere or diversify away from you – in competitive markets, that may be tolerable in the medium term, but the power balance shifts over the long-term

😬 The suppliers go out of business – you then have the headache of replacing them.

If you’re a supplier, recognise:

😬 You are accountable and should be transparent – there’s no good reason not to be.

😬 Share the pain, where you can, with customers facing financial pressures.

😬 Be creative – there’s always more than one way to solve a problem (and recognise that’s you’re ONE job – make things better than they were).

Furthermore, for those of us working in risk and compliance, if we don’t recognise the pressures on the supplier-buyer dynamic, we’ll miss fraud and other malfeasance. Why? As someone operating in both capacities (supplier and buyer), if there isn’t equity, there will be resentment, and that never ends well.