Evasive, Shadowy, and Garbled

Over the holidays, I got stuck into some further studies – Wharton’s ESG courses.

Going back to the source information, the “Core Metrics and Disclosures,” a lot of discussion focuses on data availability and the challenges it causes. To summarise:

👉 Sentiment data

👉 Self-reported data (e.g., sustainability report)

👉 Metrics

The first is often about trawling the ether for negative or positive reviews, reports, etc. But how is this done evenly – language coverage, factoring censorship and press/personal freedoms in countries or operations, access to the internet, etc – is lacking. The middle one is problematic, as there’s an interest in relaying good news and muffling bad stuff. But the metrics confused me and led me to the tongue-in-cheek alternative acronym in the title 👆.

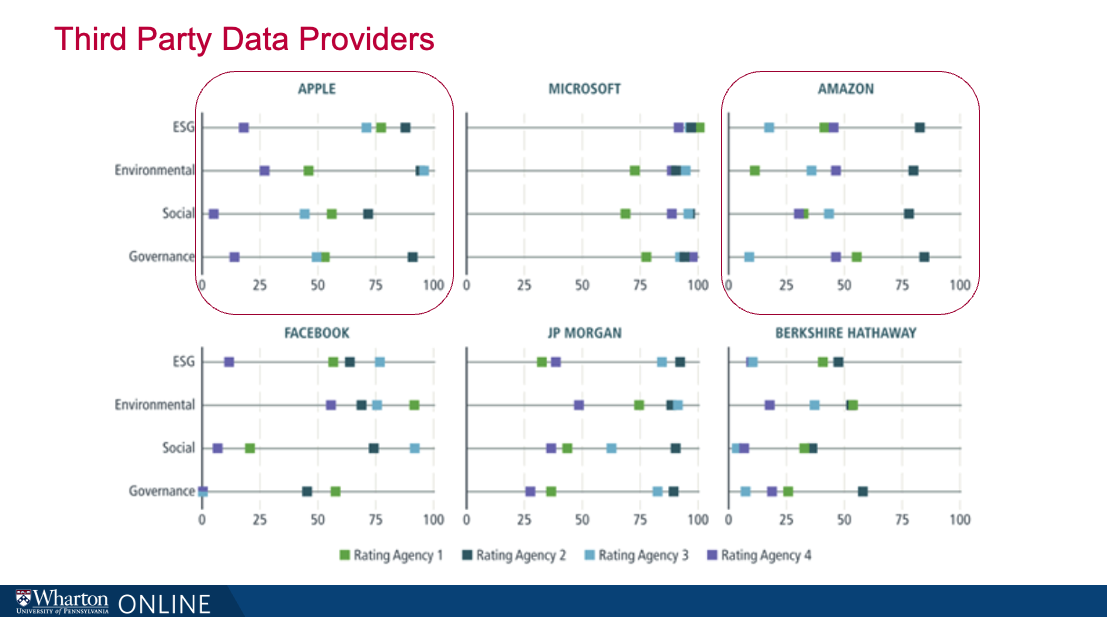

The image below better illustrates the challenge, showing how various rating agencies scored companies – Amazon and Apple – very differently. Why?

Well, we don’t have agreed metrics. How do we rate Amazon’s employee treatment? What about Apple’s promises around conflict metals and minerals, juxtaposed with the relentless pressure to bring out new models and build in obsolescence?

In the face of this chaos, some call for standardised rules and frameworks. I get that. But it makes me very nervous because:

🫨 “Solutions” bring new problems that we seldom fully understand (at the beginning) – we heralded the arrival of the cleaner automobile as it cleared our cities of pollution (horse 💩).

🫨 We disagree on the parameters – for example, the debate continues around greenhouse gas emissions. Let’s say you work in mixed agriculture. We’re now uncovering how soil health and its ability to capture carbon could be game-changing. Regeneratively managed livestock can help improve soil quality. But simultaneously we face pressures to move to “plant-based,” which can negatively impact soil health (and biodiversity) by using intensive monoculture practices.

🫨 S and G elements cannot be measured consistently globally – avoiding human rights issues in Finland is much easier than in Cambodia.

The last point I touched on a little clumsily in this recent interview with Ethikos. I paralleled an aid agency (yes, I know they’re not ESG-rated yet) having to placate unsavoury warlords to reach starving people versus a smug beer brewer who grandstands on social issues from the comfort of the UK. Is it fair to give the latter a better rating? Should ESG not consider the context, purpose, and intention of the organisation?

So, what to do about ESG? Go beyond. Yes, you may need to report on certain data points, but it’ll help to have a broader risk, sustainability, and impact focus that mirrors what you do, your purpose, and your strategy. More simply, don’t treat all 20-30 metrics (typically) as equal, risk-rank, prioritise, and focus on those with multiplier benefits to your organisation (and its mission). Are you confused about how? Get in touch.